Exemptions

The Town of Tiverton has several types of Exemptions available. There is an application process for each one. Most of these applications are due by March 15 to Tax Assessor's Office and need only to be submitted once, except for the annual Elderly Low Income.

GENERAL EXEMPTIONS

Applications for all exemptions are available in the Tax Assessor's Office.

Application for the following Veteran Exemptions HERE.

Veteran Exemption: $220 Tax Credit.You must have served honorably during the qualifying dates (see below) and/or have earned a Campaign Ribbon or Expeditionary Medal. The Veteran's unmarried widow(er) may continue to receive this exemption.

Qualifying Dates can be found HERE and HERE. *

* As of late 2021, any person who served in the Cold War through 1991, is eligible for the Veteran Exemption. As of 2023, National Guard Veterans are eligible.

Gold Star Parent Exemption: $132 tax credit. Is given to a parent who lost a son or daughter while in service to their country.

100% Service Connected Disabled Veteran Exemption: $440 tax credit. Must present a letter stating that you are classified as 100% disabled, service related.

Ex-Prisoner of War/Unmarried Widow(er) Exemption: $1,000 tax credit.

Merchant Marine Exemption: $220 tax credit.

Tax Assessor David Robert and his staff sincerely thank all of our Veterans who have served our country.

Police & Fire - Surviving Spouse: Property exempt from Taxation

Per Rhode Island Statute 44-5-13.40, the real property (primary residence) of the surviving spouse of any law enforcement officer or firefighter who was killed in the line of duty shall be exempt from taxation.

Blind Exemption: $330 tax credit. (Certified by RI Services for the Blind).

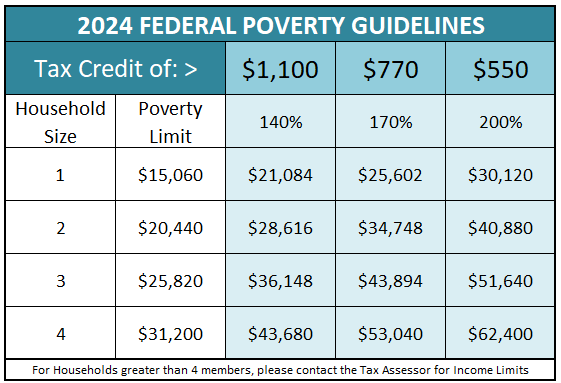

Elderly Low Income Exemptions are income-based utilizing the Federal Poverty Guidelines. A tax credit ranging between $550 and $1,100 is provided depending on the household size and income. For 2023, the income limits are:

In addition to the income limits outlined above, the applicant must have been a resident in the Town of Tiverton for a term no less than 3 years prior to the year in which the exemption is sought. The applicant must be at least 65 years of age as of December 31st in the year immediately preceeding, and no income bearing commercial or mixed use properties qualify.

Contact the Tax Assessor's office for full details.

Link to Poverty Guidelines

Hardship Exemptions are available on a case by case basis. Please contact the Tax Assessor's office for details and applicaiton.

Historic Homes Tax Credit (This is a state program, not a town credit). Follow this LINK for information.

Farm, Forest and Open Space Program (FFOS).

This program can provide qualifying land owners a considerable reduction on their land assessment(s). The guidelines for the FFOS program are governed by the Divison of Environmental Management (DEM). Property Owners wishing to apply for either the Farm or Forest programs must file an original application with DEM. The Open Space portion is handled by the Tax Assessor's Office. We urge you to read the guidelines to fully understand what program will work best for you. The Eastern Rhode Island Conservation District can provide additional assistance by following this LINK. In most instances, you will need to contact them for supporting documentation and signatures.

DEM's full Rules and Regulations on the FFOS programs are HERE.

State Statute(s) that outlines Taxation of Farm, Forest, and Open Space Land are HERE.

In order to recieve a reduction in your land assessment(s), an additional Tax Assessor application MUST be filed between December 1 and January 31. The type of additional application will vary depending on what program you qualify for. It is highly recommended that you personally visit the Tax Assessor's office between the posted dates to fill out the proper form. No assessment (tax) reduction will be applied automatically upon DEM approval, you must fill out a local application as well.

For continued qualification, Yearly Affirmation Forms are mailed out to each participant in the program which must be signed and returned by January 31.

For 2023, the recommended assessed values are:

Farms:

Ornamental Crops, including land devoted to floriculture, nursery, and turf production, as well as the land under greenhouses: $1,955 per acre.

Vegetable and Orchards, including small fruits, potatoes, cranberries, and Christmas trees: $650 per acre.

Dairy and Livestock, including forage crops, hay, silage corn/grain, and aquaculture: $300 per acre.

Forest and Wasteland on a farm: $115 per acre.

A minimum of 5 acres of active farmland will be required in most cases.

Forest:

All forest land: $115 per acre. Must have at least 10 acres excluding any homesite.

Open Space:

Recommended values for open space are 10%, 20%, or 30% of current assessments based on Fair Market Value, depending on which of the three categories of soil are present on the parcel.

10% - Soils with severe limitations

20% - Soils with moderate limitations

30% - Soils with slight limitations

In the absence of a soil survey map provided by the landowner to the Tax Assessor, open space land will be assessed at 30% of the current assessment. Parcel must contain at least 10 acres excluding any homesite.

Soil maps can be obtained from the Eastern Conservation District.

Withdrawal From Program:

If you withdraw enrolled parcels prior to the 15th year of classification, a Use Change Penalty Tax may apply. Please follow this LINK for detailed information.

Residential Development Property Exemption

Per Rhode Island General Law, certain development property is eligible for a partial tax exemption. To be qualified as "Development Property", please click HERE for details. If you feel your property qualifies, please submit this APPLICATION.